USEFUL LIFE

Useful Life is an accounting term that measures how long an asset can be used to effectively generate revenue. For example, if you buy a building as a property investment, the useful life of that building would be how long the building is estimated to last as an asset that can be used to effectively generate revenue for its owner.

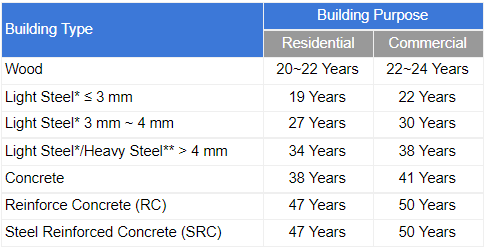

For calculating the useful life of a building in Japan, there are two factors you need to consider: the building type and the building purpose. Relative to these two factors, the useful life of a building will differ. For example, an apartment building made out of wood is not going to have as long a useful life as a skyscraper made out of reinforced concrete and used for commercial purposes.

The National Tax Agency in Japan, has a table outlining the useful life of buildings relative to these two factors. Please see below for details.

For calculating the useful life of a building in Japan, there are two factors you need to consider: the building type and the building purpose. Relative to these two factors, the useful life of a building will differ. For example, an apartment building made out of wood is not going to have as long a useful life as a skyscraper made out of reinforced concrete and used for commercial purposes.

The National Tax Agency in Japan, has a table outlining the useful life of buildings relative to these two factors. Please see below for details.

When purchasing a used property, the remaining useful life will vary relative to how old the building is. The formula for calculating the remaining useful life of a building in general is as follows:

Useful Life - Age of the Property = Property’s Remaining Useful Life

For example, if you wanted to know how much useful life was left on a SRC apartment building built 20 years ago, then the formula would be as follows:

Useful life for SRC residential buildings is 47 years according to the table above

Age of the property is 20 years

47 years - 20 years = 27 years of remaining useful life

Useful life is key to calculating depreciation, loan amortization, among other financial calculations that are used to assess the viability of a real estate investment.

*It should be noted that the thickness of the steel determines the useful life of steel frame buildings. Light Steel is defined as steel that is less than 6 mm thick. For Light Steel buildings, the useful life differs relative to the thickness of the steel.

**Heavy Steel is greater than or equal to 6 mm thick. As a general rule, Heavy Steel residential buildings will always have a useful life of 34 years.

References: https://www.investopedia.com/terms/u/usefullife.asp

https://www.keisan.nta.go.jp/h29yokuaru/aoiroshinkoku/hitsuyokeihi/genkashokyakuhi/taiyonensutatemono.html

https://sumai-step.com/column/article/5897/

Useful life for SRC residential buildings is 47 years according to the table above

Age of the property is 20 years

47 years - 20 years = 27 years of remaining useful life

Useful life is key to calculating depreciation, loan amortization, among other financial calculations that are used to assess the viability of a real estate investment.

*It should be noted that the thickness of the steel determines the useful life of steel frame buildings. Light Steel is defined as steel that is less than 6 mm thick. For Light Steel buildings, the useful life differs relative to the thickness of the steel.

**Heavy Steel is greater than or equal to 6 mm thick. As a general rule, Heavy Steel residential buildings will always have a useful life of 34 years.

References: https://www.investopedia.com/terms/u/usefullife.asp

https://www.keisan.nta.go.jp/h29yokuaru/aoiroshinkoku/hitsuyokeihi/genkashokyakuhi/taiyonensutatemono.html

https://sumai-step.com/column/article/5897/